Backing our community

Backing better bottom lines

“I was scared. I was nervous. I wanted to go home and sleep. But I got through it. I learned social skills, an understanding of recycling, warehousing… forklifting was another skill. Cert I and Cert III in Conservation and Land Management – I’ve got them now.”

Marley was talking about his experiences applying for a traineeship on our Rail Trail project, which is run by Substation33. Since he turned 13, he had wanted to join the army but lacked the confidence to apply. With our help, Marley submitted an application, which was accepted before he completed his traineeship. He’s now in combat training.

Money matters. In 2019–20 we enhanced our efforts to help people increase their incomes through two new programs. Our Financial Capability Hub continued to back people to manage their money well through difficult times.

In 2019-20, we introduced two new employment-focused programs under the Spark banner. The Queensland Department of Housing and Public Works provided funding for an employment mentor to help people facing homelessness find work. From late January to June 2020, the Spark mentor worked with 47 people: 14 gained work despite the impacts of COVID-19. A further 11 people linked with training and many more are on track to achieve work or training goals.

The Queensland Department of Employment, Small Business and Training commissioned us to trial a Create Your Future Job project, with a mentor helping people develop their own small businesses. This project builds on our work with public housing tenants in 2018-19 to create pathways into self-employment under the tenant engagement program. From November 2019 to June 2020, our mentor worked with 28 people who had dreams of self-employment. Many made great progress, although the COVID-19 pandemic made it difficult for some.

Meanwhile our ParentsNext team continued to back parents of young children to improve their work readiness so they could move into the workforce when they were ready. In 2019-20, our ParentsNext workers operated from community venues in Yarrabilba, Underwood, Waterford West and Browns Plains as well as YFS offices at Slacks Creek and Jimboomba to empower more than 700 Logan parents. About 50 of these parents started jobs and more than 100 started study during the year.

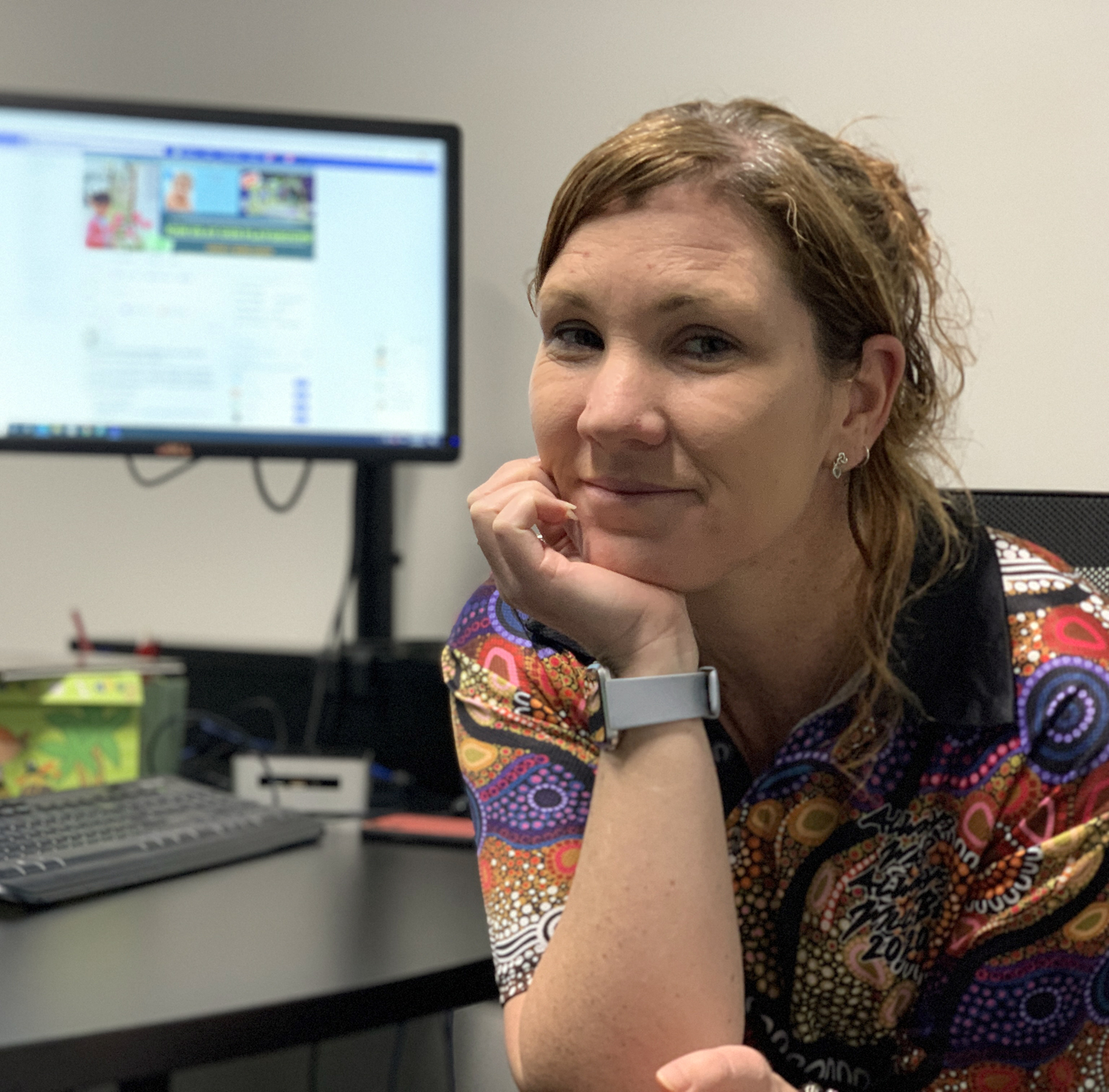

Substation33 gave 16 First Nations jobseekers like Marley (above) the chance to undertake traineeships in land management on the Beaudesert to Bethania Rail Trail. As well, volunteering at Substation33 provided a stepping stone to work for 600 people.

Our financial counsellors and financial capability workers, including our AGL energy specialist, helped people sort out their financial situations and reduce their debt levels. During 2019-20, we assisted 100 people to secure waivers for unfair debts worth around $830,000. Our YFS Connect team worked with people in hardship to develop budgets, using emergency relief funding and advocacy to help people get back on track.

- Future focus

- In 2020-21, our financial counselling team will become a State Penalties Enforcement Registry (SPER) Hardship Partner, enabling us to work with people to reduce or manage their state government debts.

- The ongoing impacts of COVID-19 will be a focus for our financial work in 2020-21 as government income supplements reduce and deferred debts need to be paid.

- Community education aims to prevent financial problems

The team at our Financial Capability Hub is always looking for new ways to reach people who might be at risk of financial distress. In 2019-20, we organised events with our colleagues from the Logan Financial Literacy Action Group, as well as through schools and other organisations. One of our financial counsellors regularly featured on Logan Radio to discuss hot topics.

Additionally, we collaborated with Mums n’ Bubs – Logan, Logan’s largest Facebook group, to provide on-the-spot advice to people through a series of live Q&As. Our work gave the group’s 22,000 members access to expert information about such topics as pay day loans, bankruptcy, no interest loans, tenancy issues, SPER debts and car finance options, and encouraged them to seek help from financial counsellors if they needed it.

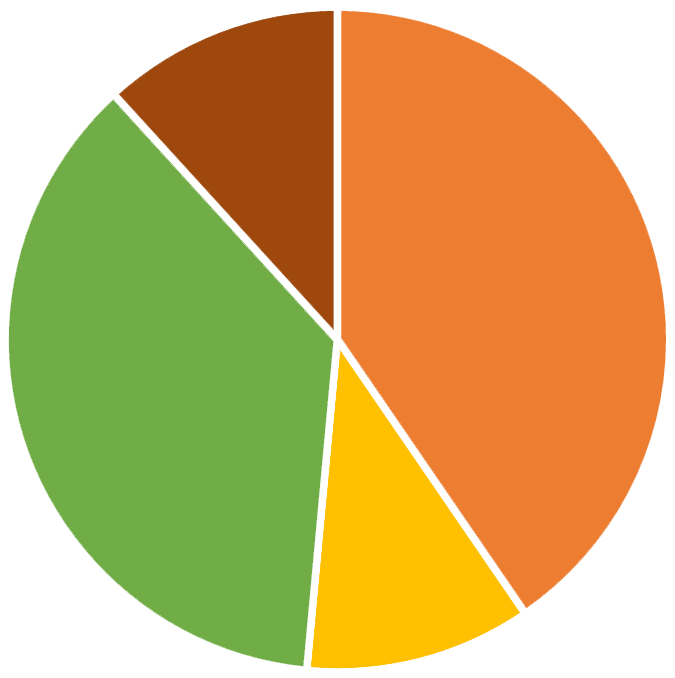

- Impact: stronger financial positions

Our financial counsellors and financial capability workers were particularly effective in helping people to improve their financial positions and skills, to better manage their money. A total of 44% of people working with our specialists reported their financial situations were greatly improved, while 32% said their situations were slightly improved. For many, the bottom line was that their incomes were inadequate. Where possible, we backed these people to improve their employment prospects.

Transitioned to employment 2019-20

- Substation33 - 55

- Spark (6 months) - 14

- ParentsNext - 50

- Rail Trail - 16

Source: YFS program data

Spark re-ignites Donna’s job prospects

“The support from YFS was totally amazing. It changed my life. I was six weeks behind in my rent, worrying about losing my car… and where my next meal was coming from. I walked up here and I met the lovely Vanessa, told her my story. Within a heartbeat she was helping me. They just listened and just showed empathy. Without them, I don’t know where I’d be. I think I would be homeless.”

The Department of Housing and Public Works created a short film about our Spark client Donna and the support we provided during the COVID-19 outbreak to help her enter the workforce.